How Does A Staffing Company Make Money

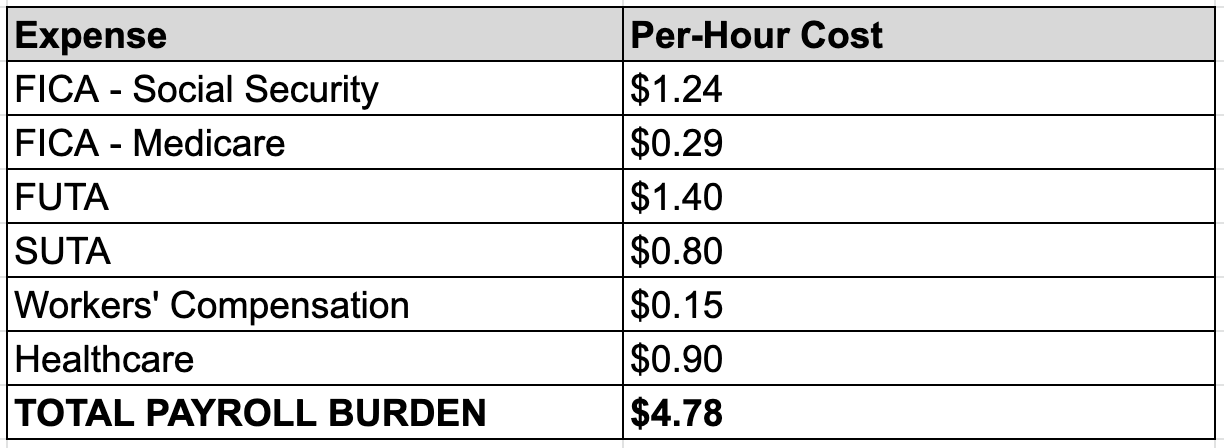

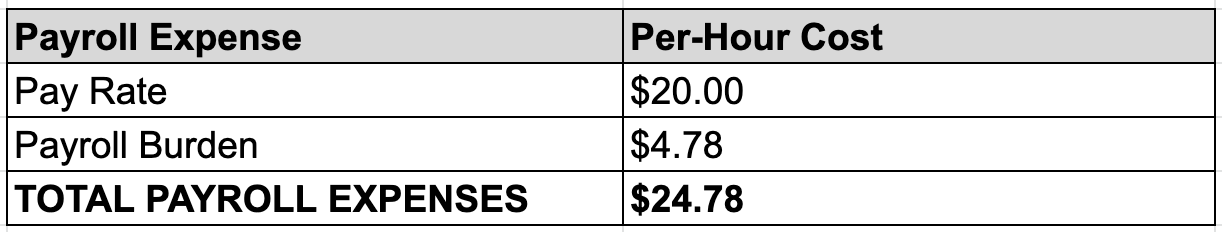

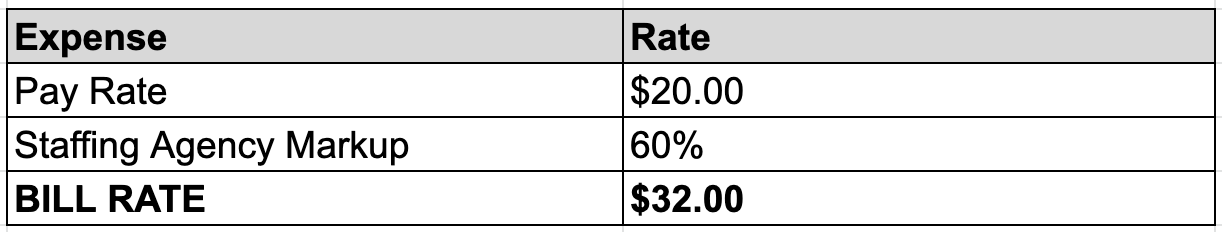

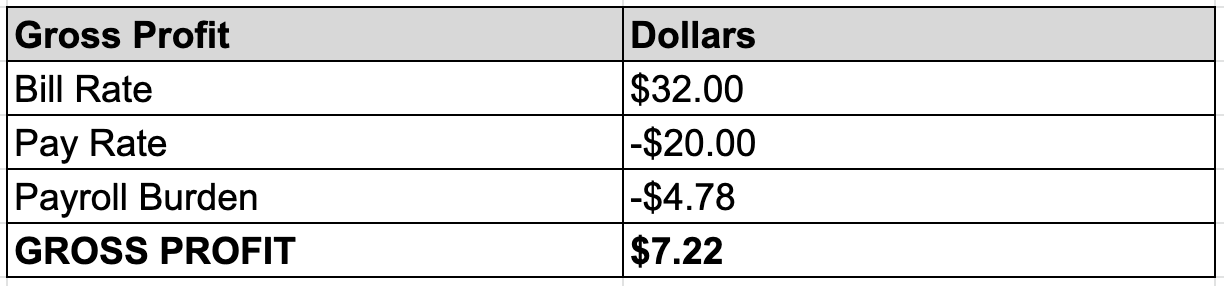

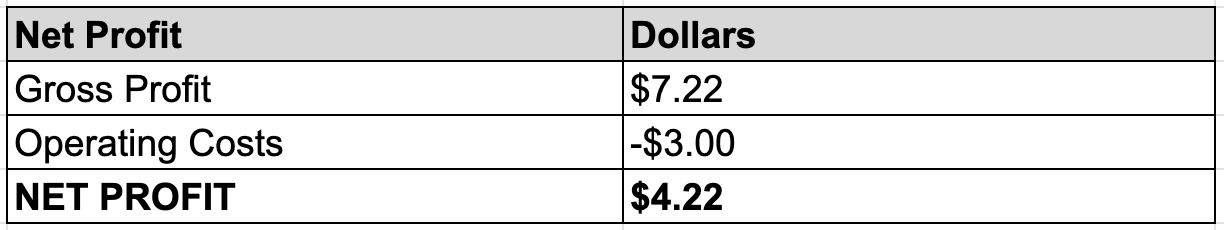

There isn't a template or simple rubric for pricing your staffing business. That'due south because in that location are many factors to consider when calculating the profit you volition expect to earn from a task placement. Although this guide doesn't cover every factor for computing net profit that may exist relevant to your specific staffing agency, we do comprehend the primary elements you lot demand to empathise. Past agreement the important components below, you volition have a improve understanding of the status of your business and how you can suit the staffing markup to reach better profit margins. To empathize how to compare Employer of Tape (EOR) services to optimize your staffing firm's compliance and efficiencies, download our FREE E-Volume to increase profits while lowering your overall risk. The bill charge per unit is the amount per hour that you charge clients. Your bill rate includes your staffing bureau markup. The average staffing agency markup for temporary employees can range anywhere between 20 – 75%. Permanent placement markups are typically 10 – 20% of the employee's gross annual salary. Information technology's important to note that staffing agency markups vary based on several factors including competition, client relationships, industry, and the local market. The pay rate is the corporeality per hour that you pay your employees. The majority of your bill rate goes to your employee's wages. Payroll burden includes the regulatory and benefits costs associated with each employee. Since payroll burden is impacted past various factors like current federal regulation and location, beneath are the most mutual costs in the United states. The Federal Insurance Contributions Act (FICA) funds Social Security and Medicare through payroll taxes on both employers and employees. FICA taxes apply almost across the board to all employees. The current FICA withholding rate for employers is 7.65%. six.2% on earnings up to $117,000 goes to Social Security and 1.45% (with no cap) goes to Medicare. Unemployment insurance is paid past the country and federal regime to employees who lost their job through no error of their own. Employer-paid unemployment insurance taxes fund these safe cyberspace programs. The federal unemployment insurance tax (FUTA) rate is a standard 6% of the employee'due south earnings up to $seven,000 for employers. The land unemployment insurance tax (SUTA) charge per unit varies by state. Information technology'south too based on your Unemployment Insurance Experience Rating, which is the likelihood that you volition lay off staff. Workers' compensation insurance provides cash payments to employees who suffer on-the-task injuries for medical treatments and lost wages. Your workers' compensation insurance charge per unit depends on several factors including which country you're in, employee classification code (type of work), and your company's history of workplace injuries. Employers pay their workers' bounty premiums per $100 of payroll. Lower take chances jobs like clerical/administrative piece of work are charged lower rates than college risk jobs like construction or manufacturing. For example, an employer could be charged $0.15 per $100 of taxable wages paid to an administrative banana as the workers' bounty insurance premium for that employee. The Affordable Intendance Human activity mandates employers with over 50 employees to provide health insurance benefits. Country and local jurisdictions may have additional healthcare or sick go out requirements. Your healthcare costs will depend on your location, the type(south) of health insurance you offer, and what your employees choose. Depending on your location, you may be required to pay country, canton, municipality, or regional taxes. These are additional costs associated with hiring and employing someone including background checks, 401(K) contributions, transit passes, parental go out, etc. In this example, a staffing agency is placing an administrative banana earning $twenty per hour. The per-hour payroll burden costs are calculated in the table beneath. Call up that at that place are a variety of factors that can impact your payroll burden costs including work location. This is where you lot will add your staffing agency markup to your pay rate. Read our guide on how to use our FREE Gross Profit Margin Calculator for Staffing Agencies. Internet turn a profit is the overall profit your staffing agency will make after you lot pay for your operating costs. These costs include your wages, role space, marketing, insurance, and other expenses to run the concern. In this example, your operating costs are cleaved down to $3.00 per hour, per employee. Download our Gross Profit Margin Calculator to take control of your staffing agency'south pricing strategy and remain competitive in the irresolute market. Have questions? Schedule a phone call with one of our staffing experts. Components for Calculating Staffing Agency Net Profit

Beak Charge per unit

Pay Charge per unit

Payroll Burden

FICA Taxes

Federal & Country Unemployment Insurance Taxes

Workers' Compensation Insurance

Healthcare

Additional State & Local Taxes

Miscellaneous / Discretionary Costs

Example – Calculating Staffing Bureau Turn a profit

Table i. Calculate Payroll Brunt

Table 2. Calculate Toll of Payroll

Table iii. Calculate Neb Rate

Table 4. Summate Gross Profit

Table v. Summate Net Profit

Summate Your Gross Turn a profit Margin

Source: https://www.headcountmgmt.com/articles/how-to-calculate-staffing-agency-net-profit

Posted by: acostakness1960.blogspot.com

0 Response to "How Does A Staffing Company Make Money"

Post a Comment